PSLF Loan Forgiveness Form – The PSLF form is an electronic record of your work history for 10 years. Affirmation to increase the amount you receive in PSLF payments. The deadline for appeal is 2024. If you are employed by multiple agencies, you could be eligible for a lower payment waiver. Learn more about PSLF benefits and how to fill out the form.

PSLF form provides a 10-year digital trail of your job history

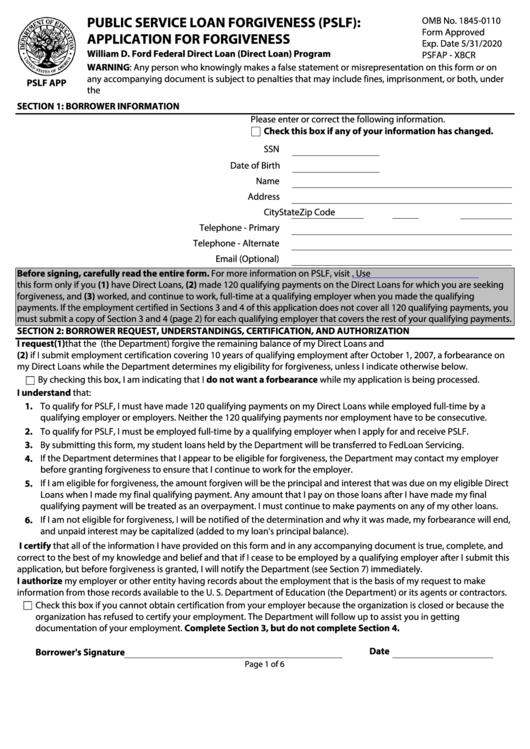

The PSLF Form is a digital trail which records your employment record for a period of 10 years. It is then added to your student loan record. It is used for tracking your eligibility for employment, making an account of eligible payments as well as determining whether employers can be part of the repayment program. The Department of Education recommends that you renew your certification of employment whenever you change employers or modify an income-driven repayment program.

You have to file an Employment Certification Form each year for each year if you wish to be considered eligible for the PSLF program. This form verifies that you’re employed and meets other requirements. It is vital to file the form every year, since it is the sole proof the government has of your employment during the 10 year forgiveness period.

The PSLF form has to be signed by an HR Department Human Resources Analyst, and the employee must be able to sign the form. The form must be signed by a Department Human Resources Analyst. The employee must complete the form by no later than October 31, 2022. You may need to take additional administrative steps for the U.S. Department of Education. Follow these guidelines.

The federal government sponsored the development and funding of the PSLF program. The Human Resources Department of Monterey provides advice to PSLF applicants. Additionally, the Human Resource Analyst will verify dates on your application. If you’re not qualified to participate in the PSLF program, you might be required to consolidate your federal loan prior to the time limit expires. It is recommended to read the conditions of the waiver prior to filling out the PSLF form.

It allows you to contest the payment amount.

There are many ways to appeal your PSLF payment count form if you believe you’ve been in arrears with the payment. You should first identify your payment’s number. Sometimes, the payment count may be incorrect. Sometimes, the servicer will provide you with a wrong number for example “Undetermined” or “Not a borrower who is qualified.” Although it’s not a sign that there was a mistake, it isn’t the perfect system. There are plenty of support and resources available to you.

After that, go over your financial aid summary. You can then determine your eligibility for PSLF. PSLF waivers are available. PSLF waiver is available when you’re a recipient of the Federal Family Education Loan (Direct Consolidation Loan) or a Federal Direct Consolidation Loan. You can also use the PSLF Help Tool to determine if you’re eligible to receive PSLF.

PSLF is an federal program that permits you to pay off your federal student loans following 120 payments verified. If you’re denied, you can appeal your decision. You can start the appeal process by visiting the federal Student Aid website, or contact your PSLF provider. You can also contact the Ombudsman Group for help.

The PSLFHelp Tool to determine the next steps in case you are not receiving the correct amount of payments. The U.S. Department of Education can provide this tool. It will provide you with the forms you need to fill out to prove your eligibility for employment and get credit for your monthly payments. Keep any receipts you receive in digital format or statements you receive in order to prove your payments.

It is scheduled to end in 2024.

Borrowers are encouraged to seek forgiveness before the PSLF Form ends in 2024. The program allows you to ask for forgiveness of federal student loan debt provided you meet the criteria. The deadline for PSLF applications is October 31st. The education department will evaluate applications and notify borrowers who might be eligible to be forgiven. If your request is denied You are entitled to appeal to Consumer Financial Protection Bureau.

The program is only available to employees of public service and is only valid for a certain period of time. Consider that the PSLF counts your time employed in the public sector. Additionally, the calculation may include the repayment period. The PSLF is only accessible to people who are employed employed in the public service and have been recognized by the Department of Education.

The Department of Education has reduced the requirements for PSLF. Payments made on federal student loans are counted towards the 120 required payments in order to qualify. You can pay federal student loans on a monthly basis or each month in full. Each payment will count towards the PSLF.

You may want to apply earlier if you’re PSLF Application isn’t complete. After the application has been completed and approved, it will be ready for your employment certificate and forgiveness purposes. It’s similar in format to an application for employment. In it, you must fill out your personal information. After that, you must mark the boxes that indicate the reason you are filling in. You may also confirm that you were employed prior to the 120-day deadline.